AARP Missouri Advocating for Property Tax Credit Boost

For Catherine Woolridge, 68, the state’s property tax credit provides a small financial cushion, allowing her to buy some extra groceries and other necessities.

Woolridge’s credit last year was just over $700. “Every little bit helps when living on a limited income,” says the former journalist from St. Joseph who has been visually impaired since birth.

That little bit could grow under a proposal to increase the amount of the credit for low-income older adults and individuals with disabilities.

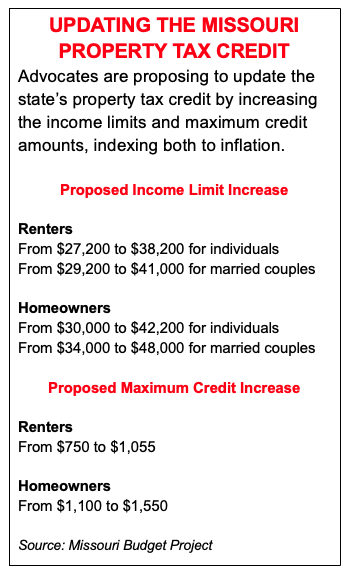

The Missouri Property Tax Credit provides up to $1,100 annually to homeowners and up to $750 to renters. But those amounts, as well as the income limits to qualify for the credit, haven’t changed since 2008—despite rising inflation, property taxes and rent.

That’s why AARP Missouri and other advocates are calling on state lawmakers to raise the maximum tax credit amount by about 40 percent, to $1,550 for homeowners and $1,055 for renters, as well as increase the income limits of who can qualify.

Many older Missourians living on fixed incomes have lost eligibility for the credit, also known as the “circuit breaker” credit, simply because of cost-of-living increases in Social Security payments, says Julie Peetz, executive director of the Missouri Association of Area Agencies on Aging.

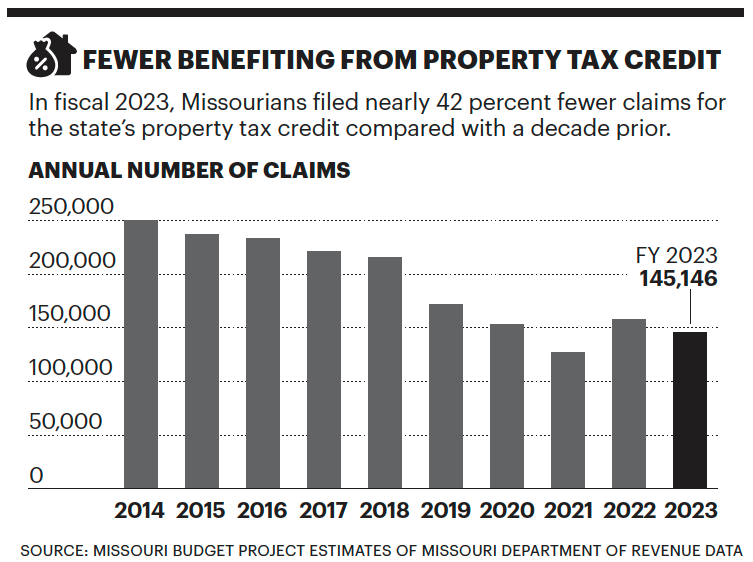

Fewer and fewer residents are able to access the credit, and more and more need it, Peetz says.

Missourians filed 145,146 property tax credit claims in fiscal 2023—down nearly 42 percent from a decade earlier, even as the number of older adults in the state rose, according to data provided by the Missouri Budget Project, which conducts research on state budget, tax and economic issues.

The total amount of the refunds for those credits has also declined in recent years, says Lindsey Baker, the nonprofit’s research director. Adjusting for inflation, credits in fiscal 2023 totaled $76.1 million, down from nearly $139 million in fiscal 2014.

To be eligible for the credit, recipients must be 65 or over, an adult under 65 who is 100-percent disabled or someone 60 and older who is receiving Social Security surviving spouse benefits. The income limit to qualify for homeowners is $30,000 for a single person and $34,000 for a married couple, while the limit for renters is $27,200 for an individual and $29,200 for a couple.

In addition to increasing the maximum tax credit, the Missouri Budget Project wants the General Assembly to increase the income limits for homeowners and renters by roughly 40 percent.

Taking action

AARP Missouri is supporting legislation that would increase the amount of both the credit and the income limit to qualify; incorporate annual adjustments to keep up with inflation; and create a more gradual reduction in the size of the credit as people near the income limit.

Previous bipartisan bills to update the tax credit haven’t made it across the finish line, but Jay Hardenbrook, AARP Missouri’s advocacy director, says support has been building. “I think a lot of people are going to be ready to act on it,” Hardenbrook says.

State Rep. Mike McGirl (R), who represents Franklin and Washington counties, plans to reintroduce a bill to raise income limits and the credit amount. McGirl, who has a private accounting practice in Potosi, sees the need for the update among his own tax clients. “So many people’s Social Security ... puts them above the threshold,” he says.

State Sen. Tracy McCreery (D-St. Louis County) will also reintroduce a bill that would increase the maximum tax credit and income limits and adjust those cutoffs annually for inflation.

The credit can have a significant impact for people with low incomes and no savings, says Mary Jo Fletchall, chief financial officer of Young at Heart Resources, an Area Agency on Aging in northwest Missouri.

Fletchall recalls helping an Army veteran who was widowed and living alone. The woman owed nearly $4,000 in unpaid property taxes and was about to lose her home. Fletchall helped her file for multiple years of tax credits, which allowed her to pay the back taxes.

“It was a godsend,” Fletchall says. “It changed her life.”

Hilary Appelman, a Pennsylvania-based writer, covers long-term care and other issues. She has written for the Bulletin since 2011.

Also of Interest

- Get Help from Property Tax Aide

- 11 Housing Options for Older Adults Who Need More Help

- Medicare Part B Premium to Increase in 2025Stay Safe From Tax Scams — AARP

This story is provided by AARP Missouri. Visit the AARP Missouri page for more news, events, and programs affecting retirement, health care, and more.

AARP Events for Jefferson City

AARP Events for Jefferson City

-

Featured Event

Trail Trekkers on the Trail at Klondike Park

Saturday, Feb 15, 2025 at 9:00 a.m. CT

Klondike Park

Augusta, MO

-

Online Class: Enhance Your Workout With Yoga Fusion

Monday, Jan 6, 2025 at 10:00 a.m. CT

Zoom

Online Event

-

Qigong with Nate: A Gentle Practice for Body, Mind and Spirit

Monday, Jan 6, 2025 at 12:00 p.m. CT

Zoom

Online Event

- Immediate access to your member benefits

- Discounts on travel and everyday savings

- Subscription to AARP The Magazine

- FREE second membership

Contact AARP

Missouri

Warning (2): include(/var/www/vhosts/vcc_staging/app/Resource/aarp2_master.footer.html) [<a href='http://php.net/function.include'>function.include</a>]: failed to open stream: No such file or directory [APP/View/Layouts/aarp_2023.ctp, line 242]Code Context<?php // if (!$nowrapper) (Globals::$language == 'es') ? include(APP . "/Resource/aarpe_footer_es.html") : include(APP . "/Resource/aarpe_footer.html"); ?><?php if (!$nowrapper): // MLW - Spanish wrappers TBDinclude (APP . "Resource/aarp2_master.footer.html");$viewFile = '/var/www/vhosts/vcc_staging/app/View/Layouts/aarp_2023.ctp' $dataForView = array( 'content_for_layout' => '<div class="row twoColumnLayout"> <div class="col-md-8 left-rail"><div class="module clearfix"><div class="ar-basic-box"> <div> <div class="module-spacer"> <header><h1 class="article-headline">AARP Missouri Advocating for Property Tax Credit Boost</h1></header> <div class="posted-on"> Posted on 11/30/24 by <b>Hilary Appelman</b> </div> </div> <div class="module-spacer"> <span class="blog-content"><p><div class="RichTextArticleBody"> <div class="RichTextArticleBody-body"><p>For Catherine Woolridge, 68, the state’s property tax credit provides a small financial cushion, allowing her to buy some extra groceries and other necessities.<br><br>Woolridge’s credit last year was just over $700. “Every little bit helps when living on a limited income,” says the former journalist from St. Joseph who has been visually impaired since birth.<br><br>That little bit could grow under a proposal to increase the amount of the credit for low-income older adults and individuals with disabilities.<br><br>The <span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://ptaconsumers.aarpfoundation.org/volunteer-states/missouri/#:~:text=Missouri's%20Property%20Tax%20Credit%20Claim,they%20pay%20for%20the%20year." target="_blank" rel="noopener noreferrer">Missouri Property Tax Credit</a></span></span> provides up to $1,100 annually to homeowners and up to $750 to renters. But those amounts, as well as the income limits to qualify for the credit, haven’t changed since 2008—despite rising inflation, property taxes and rent.<br><br>That’s why <span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://states.aarp.org/missouri/" target="_blank" rel="noopener noreferrer">AARP Missouri</a></span></span> and other advocates are calling on state lawmakers to raise the maximum tax credit amount by about 40 percent, to $1,550 for homeowners and $1,055 for renters, as well as increase the income limits of who can qualify.<br><br>Many older Missourians living on fixed incomes have lost eligibility for the credit, also known as the “circuit breaker” credit, simply because of cost-of-living increases in <span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://www.aarp.org/retirement/social-security/" target="_blank" rel="noopener noreferrer">Social Security</a></span></span> payments, says Julie Peetz, executive director of the Missouri Association of Area Agencies on Aging.<br><br>Fewer and fewer residents are able to access the credit, and more and more need it, Peetz says.<br></p><div class="Enhancement" > <div class="Enhancement-item"><figure class="Figure" data-alignment="left"> <img src="https://aarp-states.brightspotcdn.com/f9/f5/6550ea1f488d82e1f6b757e59c31/screen-shot-2024-11-27-at-1-27-14-pm.png" alt="Screen Shot 2024-11-27 at 1.27.14 PM.png" width="753" height="562" style="height: auto; max-width: 400px;"/> </figure> </div> </div><p>Missourians filed 145,146 property tax credit claims in fiscal 2023—down nearly 42 percent from a decade earlier, even as the number of older adults in the state rose, according to data provided by the <span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://mobudget.org/" target="_blank" rel="noopener noreferrer">Missouri Budget Project</a></span></span>, which conducts research on state budget, tax and economic issues.<br><br>The total amount of the refunds for those credits has also declined in recent years, says Lindsey Baker, the nonprofit’s research director. Adjusting for inflation, credits in fiscal 2023 totaled $76.1 million, down from nearly $139 million in fiscal 2014.<br><br>To be eligible for the credit, recipients must be 65 or over, an adult under 65 who is 100-percent disabled or someone 60 and older who is receiving Social Security surviving spouse benefits. The income limit to qualify for homeowners is $30,000 for a single person and $34,000 for a married couple, while the limit for renters is $27,200 for an individual and $29,200 for a couple.<br></p><div class="Enhancement" > <div class="Enhancement-item"><figure class="Figure" data-alignment="right"> <img src="https://aarp-states.brightspotcdn.com/65/dd/3724559a402ab0e243f81ca2e6dc/screen-shot-2024-12-02-at-11-06-29-am.png" alt="Screen Shot 2024-12-02 at 11.06.29 AM.png" width="352" height="575" style="height: auto; max-width: 400px;"/> </figure> </div> </div><p>In addition to increasing the maximum tax credit, the Missouri Budget Project wants the General Assembly to increase the income limits for homeowners and renters by roughly 40 percent.<br><br><b>Taking action</b><br><br>AARP Missouri is supporting legislation that would increase the amount of both the credit and the income limit to qualify; incorporate annual adjustments to keep up with inflation; and create a more gradual reduction in the size of the credit as people near the income limit.<br><br>Previous bipartisan bills to update the tax credit haven’t made it across the finish line, but Jay Hardenbrook, AARP Missouri’s advocacy director, says support has been building. “I think a lot of people are going to be ready to act on it,” Hardenbrook says.<br><br>State Rep. Mike McGirl (R), who represents Franklin and Washington counties, plans to reintroduce a bill to raise income limits and the credit amount. McGirl, who has a private accounting practice in Potosi, sees the need for the update among his own tax clients. “So many people’s Social Security ... puts them above the threshold,” he says.<br><br>State Sen. Tracy McCreery (D-St. Louis County) will also reintroduce a bill that would increase the maximum tax credit and income limits and adjust those cutoffs annually for inflation.<br><br>The credit can have a significant impact for people with low incomes and no savings, says Mary Jo Fletchall, chief financial officer of Young at Heart Resources, an Area Agency on Aging in northwest Missouri.<br><br>Fletchall recalls helping an Army veteran who was widowed and living alone. The woman owed nearly $4,000 in unpaid property taxes and was about to lose her home. Fletchall helped her file for multiple years of tax credits, which allowed her to pay the back taxes.<br><br>“It was a godsend,” Fletchall says. “It changed her life.”<br><br><i>Hilary Appelman, a Pennsylvania-based writer, covers long-term care and other issues. She has written for the Bulletin since 2011.</i><br><br><b>Also of Interest</b><br></p><ul><li><span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://www.aarp.org/money/taxes/info-2024/aarp-property-tax-aide-program.html" target="_blank" rel="noopener noreferrer"><b>Get Help from Property Tax Aide</b></a></span></span></li><li><span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://www.aarp.org/caregiving/basics/info-2022/housing-options.html" target="_blank" rel="noopener noreferrer"><b>11 Housing Options for Older Adults Who Need More Help</b></a></span></span></li><li><span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://www.aarp.org/health/medicare-insurance/info-2024/medicare-part-b-premium-increase/" target="_blank" rel="noopener noreferrer"><b>Medicare Part B Premium to Increase in 2025</b></a></span></span><br><div class="Enhancement" > <div class="Enhancement-item"><span class="VideoEnhancement" data-video-disable-history data-embeddedvideo-container> <div class="VideoEnhancement-player"><bsp-brightcoveplayer data-video-player class="BrightcoveVideoPlayer" data-account="3772599298001" data-player="KM9xJAJa4" data-video-id="5750412770001" data-video-title="Stay Safe From Tax Scams — AARP" > <video class="video-js" id="BrightcoveVideoPlayer-5750412770001" data-video-id="5750412770001" data-account="" data-player="KM9xJAJa4" data-embed="default" controls ></video> </bsp-brightcoveplayer> </div> <div class="VideoEnhancement-title">Stay Safe From Tax Scams — AARP</div> </span> </div> </div></li></ul></div> </div> </p></span> </div> </div> <p><i>This story is provided by AARP Missouri. Visit the <a href="https://states.aarp.org/region/missouri/" target="_blank">AARP Missouri</a> page for more news, events, and programs affecting retirement, health care, and more.</i></p> </div> </div><div class="module clearfix"><script src="https://aarp-states.brightspotcdn.com/resource/00000168-dd17-d487-a96e-df5fe3ee0000/styleguide/All.min.c85a242a55150cd195e494cd6e5b9c77.gz.js" async=""></script> <link rel="stylesheet" media="all" href="https://aarp-states.brightspotcdn.com/resource/00000168-dd17-d487-a96e-df5fe3ee0000/styleguide/All.min.bfe6eb5a8301841feef3af4e9bd1e26d.gz.css"> <!-- bypass --> <style> a:focus, a:hover { text-decoration: underline; } h1.article-headline { margin: 0 0 1rem; } </style> <!-- <style> .Enhancement-item .Figure { margin-bottom: 24px; } .RichTextArticleBody-body ul { margin-bottom: 24px; } .RichTextArticleBody-body p{ margin: 12px 0; } .RichTextModule-items { clear: both; display: table; width: 100%; margin-bottom: 12px; } .VideoEnhancement>* { color: var(--primaryTextColor); font-size: 13px; font-weight: 400; line-height: 1.4; font-style: italic; background: #f0efed } @media only screen and (min-width: 768px) { .VideoEnhancement>* { font-size:14px; font-weight: 400; line-height: 1.47 } } .VideoEnhancement-title { padding: 20px } @media only screen and (min-width: 768px) { .VideoEnhancement-title { padding:30px } } .VideoEnhancement-player>* { position: relative; width: 100%; height: 0; padding-bottom: 56.25% } .VideoEnhancement iframe { border: 0; position: absolute; top: 0; left: 0; width: 100%; height: 100% } [data-video-player] { display: block; padding-bottom: 56.25%; height: 0; margin: 0 auto; } [data-video-player][data-aspect-ratio="4x3"] { padding-bottom: 56.25%; } [data-video-player][data-aspect-ratio="16x9"] { padding-bottom: 56.25% } </style> --></div><div class="module clearfix"><div class="module-spacer tout-homefit-750"> <a data-formelementid="CSN-LOCAL-HC-NEWSSK-02272024" href="/jefferson-city-mo/home-and-community/?intcmp=CSN-LOCAL-HC-NEWSSK-02272024"><img class="img-responsive" alt="Explore the free AARP HomeFit Guide" title="Explore the free AARP HomeFit Guide" src="https://cdn-aarp.americantowns.com/img/touts/HomeFit_750x150.png"></a> </div></div></div> <div class="col-md-4 right-rail thin-rhs"><div class="module clearfix"><!--default--> <!-- module_RHS - AARP Events --> <div class="ar-basic-box module-spacer"> <header> <div class="pull-right"> <a href="/jefferson-city-mo/aarp-events/" data-formelementid="LOCAL-BTN-CLK-SEEALL-EVENTS"> <img style="width:30px;" src="https://cdn-aarp.americantowns.com/img/template/icons/aarp_event_icon.png" alt="Upcoming AARP Events" /> </a> </div> <h2 class="visible-lg">AARP Events for Jefferson City</h2> <h2 class="hidden-lg">AARP Events for Jefferson City</h2> </header> <div class="wrap"> <div class="ar-listing snippet"> <ul class="list"> <li class="item" data-pageindex="1"> <h3 class="topic">Featured Event</h3> <h2 class="title"><a href="/aarp-event/aarp-mo-trail-trekkers-klondike-park-augusta-mo-21525-9rn7hnfm27y.html" data-formelementid="LOCAL-BTN-CLK-EVENTS-TRAIL-TREKKERS-ON-THE-TRAIL-AT-KLONDIKE-PARK">Trail Trekkers on the Trail at Klondike Park</a></h2> <p class="time">Saturday, Feb 15, 2025 at 9:00 a.m. CT</p> <p class="venue">Klondike Park</p> <p class="loc">Augusta, MO</p> </li><li class="item" data-pageindex="1"> <h2 class="title"><a href="/aarp-event/aarp-nm-fitness-virtual-yoga-class-santa-fe-nm-162025-h9ng8xp9srw.html" data-formelementid="LOCAL-BTN-CLK-EVENTS-ONLINE-CLASS-ENHANCE-YOUR-WORKOUT-WITH-YOGA-FUSION">Online Class: Enhance Your Workout With Yoga Fusion</a></h2> <p class="time">Monday, Jan 6, 2025 at 10:00 a.m. CT</p> <p class="venue">Zoom</p> <p class="loc">Online Event</p> </li><li class="item" data-pageindex="1"> <h2 class="title"><a href="/aarp-event/aarp-wy-flowstate-fitness-with-nate-01062025-7xn3djf69f6.html" data-formelementid="LOCAL-BTN-CLK-EVENTS-QIGONG-WITH-NATE-A-GENTLE-PRACTICE-FOR-BODY-MIND-AND-SPIRIT">Qigong with Nate: A Gentle Practice for Body, Mind and Spirit</a></h2> <p class="time">Monday, Jan 6, 2025 at 12:00 p.m. CT</p> <p class="venue">Zoom</p> <p class="loc">Online Event</p> </li> </ul> <p><a class="link-red" href="/jefferson-city-mo/aarp-events/" data-formelementid="LOCAL-BTN-CLK-SEEALL-EVENTS">View All AARP Events<i class="ml-1 fas fa-chevron-right"></i></a></p> </div> </div> </div> <div aria-hidden="true" class="aarpe-ad-wrapper"> <div class="aarpe-ad en clearfix" id="300x250_53475" data-adsize="300x250"> <script type="text/javascript"> if(typeof AARP.ads !== 'undefined'){ AARP.ads.slots({ id:'300x250_53475', size:'300x250'}); } </script> </div> </div> <div class="card-tout card-dark membership-tout" style="margin:0 0 30px 0;"> <img class="img-responsive image" title="image of two AARP membership cards" alt="image of two AARP membership cards" src="https://cdn-aarp.americantowns.com/img/tout-two-cards.png"> <div class="title">Only $12 your first year with Automatic Renewal</div> <ul class="list"> <li>Immediate access to your <a href="https://www.aarp.org/benefits-discounts/">member benefits</a></li> <li>Discounts on travel and everyday savings</li> <li>Subscription to AARP The Magazine</li> <li>FREE second membership</li> </ul> <div class="action"> <a class="btn" href="https://appsec.aarp.org/mem/join?campaignid=UAJFT3&intcmp=LNK-CSN-AARPLOCAL-JRTOUT-RR-A-JEFFERSONCITY-MO">Join AARP</a> <div class="body">Already a member? <a href="https://appsec.aarp.org/mem/renew?campaignid= UARFT3&intcmp=LNK-CSN-AARPLOCAL-JRTOUT-RR-A-JEFFERSONCITY-MO">Renew</a> or <a href="https://www.aarp.org/benefits-discounts/my-membership/print-your-card/">Print Card</a></div> </div> </div> <style> .membership-tout {padding:16px 20px;} .membership-tout .list li { margin: 0; } </style> <div aria-hidden="true" class="aarpe-ad-wrapper"> <div class="aarpe-ad en clearfix" id="300x250_93505" data-adsize="300x250"> <script type="text/javascript"> if(typeof AARP.ads !== 'undefined'){ AARP.ads.slots({ id:'300x250_93505', size:'300x250'}); } </script> </div> </div> <div class="module-spacer text-center"> <div class="fb-page" alt="Image of AARP Missouri Facebook Page" title="Image of AARP Missouri Facebook Page" data-href="https://www.facebook.com/aarpmissouri" data-tabs="timeline" width="320" height="" data-small-header="false" data-adapt-container-width="true" data-hide-cover="false" data-show-facepile="true" lazy="true"> <blockquote cite="https://www.facebook.com/aarpmissouri" class="fb-xfbml-parse-ignore"><a href="https://www.facebook.com/aarpmissouri">Facebook</a></blockquote> </div> </div> <div class="ar-basic-box module-spacer"> <header> <h2>Contact AARP<br />Missouri</h2> </header> <div class="wrap"> <div class="ar-quick-list module-spacer"> <ul class="list-unstyled"> <li><i class="list-icon fa fa-envelope" alt="Email icon" title="Email icon" aria-hidden="true"></i><a href="mailto:MOAARP@aarp.org " target="_blank" rel="noopener">MOAARP@aarp.org </a></li> <li><i class="list-icon fa fa-globe" alt="Globe icon" title="Globe icon" aria-hidden="true"></i><a href="https://states.aarp.org/region/missouri/" target="_blank" rel="noopener">AARP Missouri</a></li> <li><i class="list-icon fa fa-map-marker" alt="Map Marker icon" title="Map Marker icon" aria-hidden="true"></i><a href="https://states.aarp.org/missouri/contact-aarp-missouri-2/?intcmp=SNG-LNK-AARPLOCAL-CONTACT-20140101-JEFFERSONCITY-MO" target="_blank" rel="noopener">Contact Us</a></li> </ul> </div> <a href="https://www.facebook.com/aarpmissouri" target="_blank" rel="noopener" aria-label="Open Facebook"><img alt="Facebook icon" title="Facebook icon" src="https://cdn-aarp.americantowns.com/img/responsive/icons/48/facebook-dreamstale25.png"></a> <a href="https://twitter.com/aarpmissouri" target="_blank" rel="noopener" aria-label="Open Twitter"><img alt="Twitter icon" title="Twitter icon" src="https://cdn-aarp.americantowns.com/img/responsive/icons/48/x-logo-black.png"></a> <a href="https://www.instagram.com/aarpmontana/" target="_blank" rel="noopener" aria-label="Open Instagram"><img src="https://cdn-aarp.americantowns.com/img/icon-ig.png" alt="Instagram icon" title="Instagram icon" style="height: 49px;"></a> </div> </div> </div></div> <div class="col-md-8 left-rail left-bot"></div> <div class="col-md-4 right-rail right-bot thin-rhs"></div> </div> <div class="row oneColumnLayout"> </div> <div class="row oneColumnLayout"> <div class="col-md-12"><!-- script to activate navbar --> <script type="text/javascript"> jQuery(".channelBarMain ul.left li a").click(function() { window.location = jQuery(this).attr('href'); }); </script> </div> </div> ', 'scripts_for_layout' => '<title>AARP Missouri Advocating for Property Tax Credit Boost</title> <meta name="page_title" content="AARP Missouri Advocating for Property Tax Credit Boost"/> <meta name="robots" content="noindex, nofollow"/> <meta content="For Catherine Woolridge, 68, the state’s property tax credit provides a small financial cushion, allowing her to buy some extra groceries and other" name="description"/> <meta content="AARP, Missouri, Advocating, Property, Tax, Credit, Boost" name="keywords"/> <link rel="canonical" href="https://states.aarp.org/missouri/aarp-missouri-advocates-property-tax-credit-boost" /> <meta property="og:url" content="https://vccstaging.local.aarp.org/news/aarp-missouri-advocating-for-property-tax-credit-boost-mo-2024-11-30.html"/> <meta name="twitter:card" content="summary_large_image"/> <meta name="twitter:title" content="AARP Missouri Advocating for Property Tax Credit Boost"/> <meta name="twitter:description" content="The Missouri Property Tax Credit provides up to $1,100 annually to homeowners and up to $750 to renters. But those amounts haven’t changed since"/> <meta name="twitter:image" content="https://aarp-states.brightspotcdn.com/dims4/default/ddcf49d/2147483647/strip/true/crop/4200x2700+0+20/resize/420x270!/quality/90/?url=http%3A%2F%2Faarp-brightspot.s3.amazonaws.com%2Fstates%2F40%2F02%2F899c9adda5bec2244f3237607152%2Fproperty-tax-istock-000001893657large.jpg"/> <meta property="og:type" content="article"/> <meta property="og:title" content="AARP Missouri Advocating for Property Tax Credit Boost"/> <meta property="og:description" content="The Missouri Property Tax Credit provides up to $1,100 annually to homeowners and up to $750 to renters. But those amounts haven’t changed since"/> <meta property="og:image" content="https://aarp-states.brightspotcdn.com/dims4/default/ddcf49d/2147483647/strip/true/crop/4200x2700+0+20/resize/420x270!/quality/90/?url=http%3A%2F%2Faarp-brightspot.s3.amazonaws.com%2Fstates%2F40%2F02%2F899c9adda5bec2244f3237607152%2Fproperty-tax-istock-000001893657large.jpg"/> :root { --primaryColor: #ff1e3c; --primaryTextColor: #2a2a2a; --linkTextColor: #1f66bd; --linkHoverColor: #1f66bd; --secondaryTextColor: #000000; --secondaryColor2: #000000; --secondaryColor3: #000000; --secondaryColor4: #000000; --secondaryColor5: #000000; --black: #000000; --white: #ffffff; --grey: #f0efed; --gridGutters: 30px; --modulePadding: 60px; --pageWidth: 86.11%; --maxPageWidth: 1240px; --horizontalAlignment: center; --fontFamily: 'Roboto', sans-serif; --headerBackgroundColor:#000000; --headerTextColor:#FFFFFF; --headerHeight:50px; --footerbackgroundColor:#000000; --footerTextColor:#918883; }', 'title_for_layout' => '{local_city_c}, {local_state} Happenings - AARP' ) $content_for_layout = '<div class="row twoColumnLayout"> <div class="col-md-8 left-rail"><div class="module clearfix"><div class="ar-basic-box"> <div> <div class="module-spacer"> <header><h1 class="article-headline">AARP Missouri Advocating for Property Tax Credit Boost</h1></header> <div class="posted-on"> Posted on 11/30/24 by <b>Hilary Appelman</b> </div> </div> <div class="module-spacer"> <span class="blog-content"><p><div class="RichTextArticleBody"> <div class="RichTextArticleBody-body"><p>For Catherine Woolridge, 68, the state’s property tax credit provides a small financial cushion, allowing her to buy some extra groceries and other necessities.<br><br>Woolridge’s credit last year was just over $700. “Every little bit helps when living on a limited income,” says the former journalist from St. Joseph who has been visually impaired since birth.<br><br>That little bit could grow under a proposal to increase the amount of the credit for low-income older adults and individuals with disabilities.<br><br>The <span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://ptaconsumers.aarpfoundation.org/volunteer-states/missouri/#:~:text=Missouri's%20Property%20Tax%20Credit%20Claim,they%20pay%20for%20the%20year." target="_blank" rel="noopener noreferrer">Missouri Property Tax Credit</a></span></span> provides up to $1,100 annually to homeowners and up to $750 to renters. But those amounts, as well as the income limits to qualify for the credit, haven’t changed since 2008—despite rising inflation, property taxes and rent.<br><br>That’s why <span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://states.aarp.org/missouri/" target="_blank" rel="noopener noreferrer">AARP Missouri</a></span></span> and other advocates are calling on state lawmakers to raise the maximum tax credit amount by about 40 percent, to $1,550 for homeowners and $1,055 for renters, as well as increase the income limits of who can qualify.<br><br>Many older Missourians living on fixed incomes have lost eligibility for the credit, also known as the “circuit breaker” credit, simply because of cost-of-living increases in <span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://www.aarp.org/retirement/social-security/" target="_blank" rel="noopener noreferrer">Social Security</a></span></span> payments, says Julie Peetz, executive director of the Missouri Association of Area Agencies on Aging.<br><br>Fewer and fewer residents are able to access the credit, and more and more need it, Peetz says.<br></p><div class="Enhancement" > <div class="Enhancement-item"><figure class="Figure" data-alignment="left"> <img src="https://aarp-states.brightspotcdn.com/f9/f5/6550ea1f488d82e1f6b757e59c31/screen-shot-2024-11-27-at-1-27-14-pm.png" alt="Screen Shot 2024-11-27 at 1.27.14 PM.png" width="753" height="562" style="height: auto; max-width: 400px;"/> </figure> </div> </div><p>Missourians filed 145,146 property tax credit claims in fiscal 2023—down nearly 42 percent from a decade earlier, even as the number of older adults in the state rose, according to data provided by the <span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://mobudget.org/" target="_blank" rel="noopener noreferrer">Missouri Budget Project</a></span></span>, which conducts research on state budget, tax and economic issues.<br><br>The total amount of the refunds for those credits has also declined in recent years, says Lindsey Baker, the nonprofit’s research director. Adjusting for inflation, credits in fiscal 2023 totaled $76.1 million, down from nearly $139 million in fiscal 2014.<br><br>To be eligible for the credit, recipients must be 65 or over, an adult under 65 who is 100-percent disabled or someone 60 and older who is receiving Social Security surviving spouse benefits. The income limit to qualify for homeowners is $30,000 for a single person and $34,000 for a married couple, while the limit for renters is $27,200 for an individual and $29,200 for a couple.<br></p><div class="Enhancement" > <div class="Enhancement-item"><figure class="Figure" data-alignment="right"> <img src="https://aarp-states.brightspotcdn.com/65/dd/3724559a402ab0e243f81ca2e6dc/screen-shot-2024-12-02-at-11-06-29-am.png" alt="Screen Shot 2024-12-02 at 11.06.29 AM.png" width="352" height="575" style="height: auto; max-width: 400px;"/> </figure> </div> </div><p>In addition to increasing the maximum tax credit, the Missouri Budget Project wants the General Assembly to increase the income limits for homeowners and renters by roughly 40 percent.<br><br><b>Taking action</b><br><br>AARP Missouri is supporting legislation that would increase the amount of both the credit and the income limit to qualify; incorporate annual adjustments to keep up with inflation; and create a more gradual reduction in the size of the credit as people near the income limit.<br><br>Previous bipartisan bills to update the tax credit haven’t made it across the finish line, but Jay Hardenbrook, AARP Missouri’s advocacy director, says support has been building. “I think a lot of people are going to be ready to act on it,” Hardenbrook says.<br><br>State Rep. Mike McGirl (R), who represents Franklin and Washington counties, plans to reintroduce a bill to raise income limits and the credit amount. McGirl, who has a private accounting practice in Potosi, sees the need for the update among his own tax clients. “So many people’s Social Security ... puts them above the threshold,” he says.<br><br>State Sen. Tracy McCreery (D-St. Louis County) will also reintroduce a bill that would increase the maximum tax credit and income limits and adjust those cutoffs annually for inflation.<br><br>The credit can have a significant impact for people with low incomes and no savings, says Mary Jo Fletchall, chief financial officer of Young at Heart Resources, an Area Agency on Aging in northwest Missouri.<br><br>Fletchall recalls helping an Army veteran who was widowed and living alone. The woman owed nearly $4,000 in unpaid property taxes and was about to lose her home. Fletchall helped her file for multiple years of tax credits, which allowed her to pay the back taxes.<br><br>“It was a godsend,” Fletchall says. “It changed her life.”<br><br><i>Hilary Appelman, a Pennsylvania-based writer, covers long-term care and other issues. She has written for the Bulletin since 2011.</i><br><br><b>Also of Interest</b><br></p><ul><li><span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://www.aarp.org/money/taxes/info-2024/aarp-property-tax-aide-program.html" target="_blank" rel="noopener noreferrer"><b>Get Help from Property Tax Aide</b></a></span></span></li><li><span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://www.aarp.org/caregiving/basics/info-2022/housing-options.html" target="_blank" rel="noopener noreferrer"><b>11 Housing Options for Older Adults Who Need More Help</b></a></span></span></li><li><span class="Enhancement" ><span class="Enhancement-item"><a class="Link" href="https://www.aarp.org/health/medicare-insurance/info-2024/medicare-part-b-premium-increase/" target="_blank" rel="noopener noreferrer"><b>Medicare Part B Premium to Increase in 2025</b></a></span></span><br><div class="Enhancement" > <div class="Enhancement-item"><span class="VideoEnhancement" data-video-disable-history data-embeddedvideo-container> <div class="VideoEnhancement-player"><bsp-brightcoveplayer data-video-player class="BrightcoveVideoPlayer" data-account="3772599298001" data-player="KM9xJAJa4" data-video-id="5750412770001" data-video-title="Stay Safe From Tax Scams — AARP" > <video class="video-js" id="BrightcoveVideoPlayer-5750412770001" data-video-id="5750412770001" data-account="" data-player="KM9xJAJa4" data-embed="default" controls ></video> </bsp-brightcoveplayer> </div> <div class="VideoEnhancement-title">Stay Safe From Tax Scams — AARP</div> </span> </div> </div></li></ul></div> </div> </p></span> </div> </div> <p><i>This story is provided by AARP Missouri. Visit the <a href="https://states.aarp.org/region/missouri/" target="_blank">AARP Missouri</a> page for more news, events, and programs affecting retirement, health care, and more.</i></p> </div> </div><div class="module clearfix"><script src="https://aarp-states.brightspotcdn.com/resource/00000168-dd17-d487-a96e-df5fe3ee0000/styleguide/All.min.c85a242a55150cd195e494cd6e5b9c77.gz.js" async=""></script> <link rel="stylesheet" media="all" href="https://aarp-states.brightspotcdn.com/resource/00000168-dd17-d487-a96e-df5fe3ee0000/styleguide/All.min.bfe6eb5a8301841feef3af4e9bd1e26d.gz.css"> <!-- bypass --> <style> a:focus, a:hover { text-decoration: underline; } h1.article-headline { margin: 0 0 1rem; } </style> <!-- <style> .Enhancement-item .Figure { margin-bottom: 24px; } .RichTextArticleBody-body ul { margin-bottom: 24px; } .RichTextArticleBody-body p{ margin: 12px 0; } .RichTextModule-items { clear: both; display: table; width: 100%; margin-bottom: 12px; } .VideoEnhancement>* { color: var(--primaryTextColor); font-size: 13px; font-weight: 400; line-height: 1.4; font-style: italic; background: #f0efed } @media only screen and (min-width: 768px) { .VideoEnhancement>* { font-size:14px; font-weight: 400; line-height: 1.47 } } .VideoEnhancement-title { padding: 20px } @media only screen and (min-width: 768px) { .VideoEnhancement-title { padding:30px } } .VideoEnhancement-player>* { position: relative; width: 100%; height: 0; padding-bottom: 56.25% } .VideoEnhancement iframe { border: 0; position: absolute; top: 0; left: 0; width: 100%; height: 100% } [data-video-player] { display: block; padding-bottom: 56.25%; height: 0; margin: 0 auto; } [data-video-player][data-aspect-ratio="4x3"] { padding-bottom: 56.25%; } [data-video-player][data-aspect-ratio="16x9"] { padding-bottom: 56.25% } </style> --></div><div class="module clearfix"><div class="module-spacer tout-homefit-750"> <a data-formelementid="CSN-LOCAL-HC-NEWSSK-02272024" href="/jefferson-city-mo/home-and-community/?intcmp=CSN-LOCAL-HC-NEWSSK-02272024"><img class="img-responsive" alt="Explore the free AARP HomeFit Guide" title="Explore the free AARP HomeFit Guide" src="https://cdn-aarp.americantowns.com/img/touts/HomeFit_750x150.png"></a> </div></div></div> <div class="col-md-4 right-rail thin-rhs"><div class="module clearfix"><!--default--> <!-- module_RHS - AARP Events --> <div class="ar-basic-box module-spacer"> <header> <div class="pull-right"> <a href="/jefferson-city-mo/aarp-events/" data-formelementid="LOCAL-BTN-CLK-SEEALL-EVENTS"> <img style="width:30px;" src="https://cdn-aarp.americantowns.com/img/template/icons/aarp_event_icon.png" alt="Upcoming AARP Events" /> </a> </div> <h2 class="visible-lg">AARP Events for Jefferson City</h2> <h2 class="hidden-lg">AARP Events for Jefferson City</h2> </header> <div class="wrap"> <div class="ar-listing snippet"> <ul class="list"> <li class="item" data-pageindex="1"> <h3 class="topic">Featured Event</h3> <h2 class="title"><a href="/aarp-event/aarp-mo-trail-trekkers-klondike-park-augusta-mo-21525-9rn7hnfm27y.html" data-formelementid="LOCAL-BTN-CLK-EVENTS-TRAIL-TREKKERS-ON-THE-TRAIL-AT-KLONDIKE-PARK">Trail Trekkers on the Trail at Klondike Park</a></h2> <p class="time">Saturday, Feb 15, 2025 at 9:00 a.m. CT</p> <p class="venue">Klondike Park</p> <p class="loc">Augusta, MO</p> </li><li class="item" data-pageindex="1"> <h2 class="title"><a href="/aarp-event/aarp-nm-fitness-virtual-yoga-class-santa-fe-nm-162025-h9ng8xp9srw.html" data-formelementid="LOCAL-BTN-CLK-EVENTS-ONLINE-CLASS-ENHANCE-YOUR-WORKOUT-WITH-YOGA-FUSION">Online Class: Enhance Your Workout With Yoga Fusion</a></h2> <p class="time">Monday, Jan 6, 2025 at 10:00 a.m. CT</p> <p class="venue">Zoom</p> <p class="loc">Online Event</p> </li><li class="item" data-pageindex="1"> <h2 class="title"><a href="/aarp-event/aarp-wy-flowstate-fitness-with-nate-01062025-7xn3djf69f6.html" data-formelementid="LOCAL-BTN-CLK-EVENTS-QIGONG-WITH-NATE-A-GENTLE-PRACTICE-FOR-BODY-MIND-AND-SPIRIT">Qigong with Nate: A Gentle Practice for Body, Mind and Spirit</a></h2> <p class="time">Monday, Jan 6, 2025 at 12:00 p.m. CT</p> <p class="venue">Zoom</p> <p class="loc">Online Event</p> </li> </ul> <p><a class="link-red" href="/jefferson-city-mo/aarp-events/" data-formelementid="LOCAL-BTN-CLK-SEEALL-EVENTS">View All AARP Events<i class="ml-1 fas fa-chevron-right"></i></a></p> </div> </div> </div> <div aria-hidden="true" class="aarpe-ad-wrapper"> <div class="aarpe-ad en clearfix" id="300x250_53475" data-adsize="300x250"> <script type="text/javascript"> if(typeof AARP.ads !== 'undefined'){ AARP.ads.slots({ id:'300x250_53475', size:'300x250'}); } </script> </div> </div> <div class="card-tout card-dark membership-tout" style="margin:0 0 30px 0;"> <img class="img-responsive image" title="image of two AARP membership cards" alt="image of two AARP membership cards" src="https://cdn-aarp.americantowns.com/img/tout-two-cards.png"> <div class="title">Only $12 your first year with Automatic Renewal</div> <ul class="list"> <li>Immediate access to your <a href="https://www.aarp.org/benefits-discounts/">member benefits</a></li> <li>Discounts on travel and everyday savings</li> <li>Subscription to AARP The Magazine</li> <li>FREE second membership</li> </ul> <div class="action"> <a class="btn" href="https://appsec.aarp.org/mem/join?campaignid=UAJFT3&intcmp=LNK-CSN-AARPLOCAL-JRTOUT-RR-A-JEFFERSONCITY-MO">Join AARP</a> <div class="body">Already a member? <a href="https://appsec.aarp.org/mem/renew?campaignid= UARFT3&intcmp=LNK-CSN-AARPLOCAL-JRTOUT-RR-A-JEFFERSONCITY-MO">Renew</a> or <a href="https://www.aarp.org/benefits-discounts/my-membership/print-your-card/">Print Card</a></div> </div> </div> <style> .membership-tout {padding:16px 20px;} .membership-tout .list li { margin: 0; } </style> <div aria-hidden="true" class="aarpe-ad-wrapper"> <div class="aarpe-ad en clearfix" id="300x250_93505" data-adsize="300x250"> <script type="text/javascript"> if(typeof AARP.ads !== 'undefined'){ AARP.ads.slots({ id:'300x250_93505', size:'300x250'}); } </script> </div> </div> <div class="module-spacer text-center"> <div class="fb-page" alt="Image of AARP Missouri Facebook Page" title="Image of AARP Missouri Facebook Page" data-href="https://www.facebook.com/aarpmissouri" data-tabs="timeline" width="320" height="" data-small-header="false" data-adapt-container-width="true" data-hide-cover="false" data-show-facepile="true" lazy="true"> <blockquote cite="https://www.facebook.com/aarpmissouri" class="fb-xfbml-parse-ignore"><a href="https://www.facebook.com/aarpmissouri">Facebook</a></blockquote> </div> </div> <div class="ar-basic-box module-spacer"> <header> <h2>Contact AARP<br />Missouri</h2> </header> <div class="wrap"> <div class="ar-quick-list module-spacer"> <ul class="list-unstyled"> <li><i class="list-icon fa fa-envelope" alt="Email icon" title="Email icon" aria-hidden="true"></i><a href="mailto:MOAARP@aarp.org " target="_blank" rel="noopener">MOAARP@aarp.org </a></li> <li><i class="list-icon fa fa-globe" alt="Globe icon" title="Globe icon" aria-hidden="true"></i><a href="https://states.aarp.org/region/missouri/" target="_blank" rel="noopener">AARP Missouri</a></li> <li><i class="list-icon fa fa-map-marker" alt="Map Marker icon" title="Map Marker icon" aria-hidden="true"></i><a href="https://states.aarp.org/missouri/contact-aarp-missouri-2/?intcmp=SNG-LNK-AARPLOCAL-CONTACT-20140101-JEFFERSONCITY-MO" target="_blank" rel="noopener">Contact Us</a></li> </ul> </div> <a href="https://www.facebook.com/aarpmissouri" target="_blank" rel="noopener" aria-label="Open Facebook"><img alt="Facebook icon" title="Facebook icon" src="https://cdn-aarp.americantowns.com/img/responsive/icons/48/facebook-dreamstale25.png"></a> <a href="https://twitter.com/aarpmissouri" target="_blank" rel="noopener" aria-label="Open Twitter"><img alt="Twitter icon" title="Twitter icon" src="https://cdn-aarp.americantowns.com/img/responsive/icons/48/x-logo-black.png"></a> <a href="https://www.instagram.com/aarpmontana/" target="_blank" rel="noopener" aria-label="Open Instagram"><img src="https://cdn-aarp.americantowns.com/img/icon-ig.png" alt="Instagram icon" title="Instagram icon" style="height: 49px;"></a> </div> </div> </div></div> <div class="col-md-8 left-rail left-bot"></div> <div class="col-md-4 right-rail right-bot thin-rhs"></div> </div> <div class="row oneColumnLayout"> </div> <div class="row oneColumnLayout"> <div class="col-md-12"><!-- script to activate navbar --> <script type="text/javascript"> jQuery(".channelBarMain ul.left li a").click(function() { window.location = jQuery(this).attr('href'); }); </script> </div> </div> ' $scripts_for_layout = '<title>AARP Missouri Advocating for Property Tax Credit Boost</title> <meta name="page_title" content="AARP Missouri Advocating for Property Tax Credit Boost"/> <meta name="robots" content="noindex, nofollow"/> <meta content="For Catherine Woolridge, 68, the state’s property tax credit provides a small financial cushion, allowing her to buy some extra groceries and other" name="description"/> <meta content="AARP, Missouri, Advocating, Property, Tax, Credit, Boost" name="keywords"/> <link rel="canonical" href="https://states.aarp.org/missouri/aarp-missouri-advocates-property-tax-credit-boost" /> <meta property="og:url" content="https://vccstaging.local.aarp.org/news/aarp-missouri-advocating-for-property-tax-credit-boost-mo-2024-11-30.html"/> <meta name="twitter:card" content="summary_large_image"/> <meta name="twitter:title" content="AARP Missouri Advocating for Property Tax Credit Boost"/> <meta name="twitter:description" content="The Missouri Property Tax Credit provides up to $1,100 annually to homeowners and up to $750 to renters. But those amounts haven’t changed since"/> <meta name="twitter:image" content="https://aarp-states.brightspotcdn.com/dims4/default/ddcf49d/2147483647/strip/true/crop/4200x2700+0+20/resize/420x270!/quality/90/?url=http%3A%2F%2Faarp-brightspot.s3.amazonaws.com%2Fstates%2F40%2F02%2F899c9adda5bec2244f3237607152%2Fproperty-tax-istock-000001893657large.jpg"/> <meta property="og:type" content="article"/> <meta property="og:title" content="AARP Missouri Advocating for Property Tax Credit Boost"/> <meta property="og:description" content="The Missouri Property Tax Credit provides up to $1,100 annually to homeowners and up to $750 to renters. But those amounts haven’t changed since"/> <meta property="og:image" content="https://aarp-states.brightspotcdn.com/dims4/default/ddcf49d/2147483647/strip/true/crop/4200x2700+0+20/resize/420x270!/quality/90/?url=http%3A%2F%2Faarp-brightspot.s3.amazonaws.com%2Fstates%2F40%2F02%2F899c9adda5bec2244f3237607152%2Fproperty-tax-istock-000001893657large.jpg"/> :root { --primaryColor: #ff1e3c; --primaryTextColor: #2a2a2a; --linkTextColor: #1f66bd; --linkHoverColor: #1f66bd; --secondaryTextColor: #000000; --secondaryColor2: #000000; --secondaryColor3: #000000; --secondaryColor4: #000000; --secondaryColor5: #000000; --black: #000000; --white: #ffffff; --grey: #f0efed; --gridGutters: 30px; --modulePadding: 60px; --pageWidth: 86.11%; --maxPageWidth: 1240px; --horizontalAlignment: center; --fontFamily: 'Roboto', sans-serif; --headerBackgroundColor:#000000; --headerTextColor:#FFFFFF; --headerHeight:50px; --footerbackgroundColor:#000000; --footerTextColor:#918883; }' $title_for_layout = '{local_city_c}, {local_state} Happenings - AARP' $asset_version = '230831' $min = true $nowrapper = false $css = ' :root { --primaryColor: #ff1e3c; --primaryTextColor: #2a2a2a; --linkTextColor: #1f66bd; --linkHoverColor: #1f66bd; --secondaryTextColor: #000000; --secondaryColor2: #000000; --secondaryColor3: #000000; --secondaryColor4: #000000; --secondaryColor5: #000000; --black: #000000; --white: #ffffff; --grey: #f0efed; --gridGutters: 30px; --modulePadding: 60px; --pageWidth: 86.11%; --maxPageWidth: 1240px; --horizontalAlignment: center; --fontFamily: 'Roboto', sans-serif; --headerBackgroundColor:#000000; --headerTextColor:#FFFFFF; --headerHeight:50px; --footerbackgroundColor:#000000; --footerTextColor:#918883; }' $highlighting = '' $location = '<a href="/jefferson-city-mo/?intcmp=CSN-LOCAL-NAV-HOME">Jefferson City, MO</a>' $no_header = false $header_title = '<a href="/jefferson-city-mo/happenings/">News Feed</a>' $header_subtitle = '' $isPR = false $navbar = '<nav class="section" role="button" aria-expanded="false" aria-controls="collapse"> <div class="containerx"> <div class="section-toggle">Sections <i class="fas fa-chevron-down"></i></div> <ul class="secondary-menu containerx" id="secondary-menu" role="menu" aria-busy="true"> <li role="presentation" class=""><a role="menuitem" class="menuitem" href="/jefferson-city-mo/aarp-events/?intcmp=CSN-LOCAL-NAV-OLE" data-formelementid="LOCAL-LNK-CLK-EVENTS">Online & Local Events</a> </li> <li role="presentation" class=""><a role="menuitem" class="menuitem" href="/jefferson-city-mo/things-to-do/?intcmp=CSN-LOCAL-NAV-TTD" data-formelementid="LOCAL-LNK-CLK-THINGSTODO">Things to Do</a></li> <li role="presentation" class="active"><a role="menuitem" class="menuitem" href="/jefferson-city-mo/happenings/?intcmp=CSN-LOCAL-NAV-NF" data-formelementid="LOCAL-LNK-CLK-HAPPENINGS">News Feed</a> </li> <li role="presentation" class=""><a role="menuitem" class="menuitem" href="/jefferson-city-mo/volunteering/?intcmp=CSN-LOCAL-NAV-VOL" data-formelementid="LOCAL-LNK-CLK-VOLUNTEERING">Volunteering</a> </li> <li role="presentation" class=""><a role="menuitem" class="menuitem" href="/jefferson-city-mo/home-and-community/?intcmp=CSN-LOCAL-NAV-HC" data-formelementid="LOCAL-LNK-CLK-HC">Home & Community</a> </li> <li role="presentation" class=""><a role="menuitem" class="menuitem" href="/jefferson-city-mo/movies/?intcmp=CSN-LOCAL-NAV-MFG" data-formelementid="LOCAL-LNK-CLK-MOVIESFORGROWNUPS">Movies for Grownups</a> </li> <li role="presentation" class="more nosep " id="submenu-more"> <span role="menuitem" class="menuitem" data-formelementid="LOCAL-LNK-CLK-MORE">More<i class="fas fa-chevron-down"></i></span> <ul class="secondary-submenu animate slide-in" id="secondary-submenu"> <li role="presentation"><a role="menuitem" class="menuitem " href="/jefferson-city-mo/discounts/?intcmp=CSN-LOCAL-NAV-LO" data-formelementid="LOCAL-LNK-CLK-OFFERS">Local Offers</a></li> <li role="presentation"><a role="menuitem" class="menuitem " href="/jefferson-city-mo/local-resources/?intcmp=CSN-LOCAL-NAV-LR" data-formelementid="LOCAL-LNK-CLK-LOCALRESOURCES">Local Resources</a> </li> <li role="presentation"><a role="menuitem" class="menuitem " href="/jefferson-city-mo/jobs/?intcmp=CSN-LOCAL-NAV-WJ" data-formelementid="LOCAL-LNK-CLK-WORK&JOBS">Work & Jobs</a></li> <li role="presentation"><a role="menuitem" class="menuitem " href="/jefferson-city-mo/events/?intcmp=CSN-LOCAL-NAV-CC" data-formelementid="LOCAL-LNK-CLK-EVENTS">Community Calendar</a></li> <!-- <li role="presentation"><a role="menuitem" class="menuitem " href="/jefferson-city-mo/healthy-living/?intcmp=CSN-LOCAL-NAV-HEALTHY_LIVING" data-formelementid="LOCAL-LNK-CLK-HEALTHY_LIVING">Healthy Living</a></li> <li role="presentation"><a role="menuitem" class="menuitem " href="/jefferson-city-mo/arts-entertainment/?intcmp=CSN-LOCAL-NAV-ARTS_ENT" data-formelementid="LOCAL-LNK-CLK-ARTS_ENT">Arts & Entertainment</a></li> <li role="presentation"><a role="menuitem" class="menuitem " href="/jefferson-city-mo/museums/?intcmp=CSN-LOCAL-NAV-MUSEUMS" data-formelementid="LOCAL-LNK-CLK-MUSEUMS">Museums</a></li> --> </ul> </li> </ul> </div> </nav>' $header_custom = '' $breadcrumbs = array( (int) 0 => array( 'title' => 'News Feed', 'slug' => 'happenings' ) ) $row = array( 'title' => 'Back to News Feed', 'slug' => 'happenings' ) $i = (int) 0include - APP/View/Layouts/aarp_2023.ctp, line 242 include - APP/View/Layouts/aarp_2023.ctp, line 242 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::renderLayout() - CORE/Cake/View/View.php, line 546 View::render() - CORE/Cake/View/View.php, line 481 Controller::render() - CORE/Cake/Controller/Controller.php, line 963 AppController::renderPage() - APP/Controller/AppController.php, line 136 BlogsController::display() - APP/Controller/BlogsController.php, line 81 ReflectionMethod::invokeArgs() - [internal], line ?? Controller::invokeAction() - CORE/Cake/Controller/Controller.php, line 491 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 193 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 118